Structural Changes for Trade Relationship Between US and China Being Discussed? What This Means for Solar?

Filed under: Energy News

Comments: None

Xi and Trump have agreed to a 90 day ceasefire on future tariffs in order to discuss significant structural changes to the trading relationship between the US and China. Currently, there is a 30% tariff on any imported solar panels, which equates to approximately $0.09/watt of an installation. For utility scale solar, this would be approximately 10% of the total installation cost of a solar project. This will significantly impact the solar industry’s ability to grow and doesn’t make clear sense given the number of jobs created from solar development in the United States.

Xi and Trump have agreed to a 90 day ceasefire on future tariffs in order to discuss significant structural changes to the trading relationship between the US and China. Currently, there is a 30% tariff on any imported solar panels, which equates to approximately $0.09/watt of an installation. For utility scale solar, this would be approximately 10% of the total installation cost of a solar project. This will significantly impact the solar industry’s ability to grow and doesn’t make clear sense given the number of jobs created from solar development in the United States.

Solar Manufacturing Capacity by the Numbers

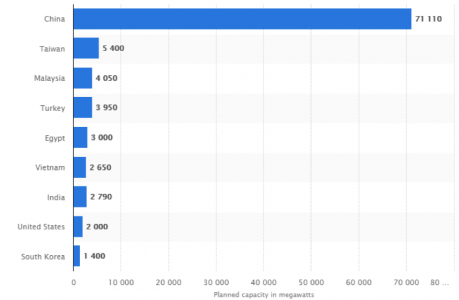

The solar industry has two primary parts in order to produce electricity from the sun. The first is the actual PV panels, or photovoltaic panels. These panels capture the sun’s energy and convert it into electricity. These panels are almost exclusively made in China, with only a small amount (about 4% market share) being made in the United States. This can be seen in the current manufacturing capacity by country, with China being the single largest producer by a large margin. There are economic reasons why this is the case, primarily a labor cost issue, that will continue to create this imbalance.

Figure 1: 2017 Solar Photovoltaic Manufacturing Capacity

*Chart from statista.com*

The Emphasis on Electrical Inverters

The other part that makes solar panels produce power are the electrical inverters. These inverters take the direct current (DC) output from the solar and invert it to Alternating Current (AC) output to the Grid. These inverters are a significant cost to every solar project and they are also technically difficult to make. The largest factor here is that the inverters die faster than the panels and thus need to be replaced more often. Paying slightly more for inverters makes sense upfront when you can have a product that lasts longer. Due to the complexity of this equipment, the industry generally buys these inverters from either the United States or Germany. There is a large emphasis in the United States for this due to the technical difficulty and electrical architectures being developed and manufactured here. China has recently opened several inverter companies, but they have not had a lot of success breaking into the developed world’s market due to concerns over their equipment’s longevity.

So essentially today, the solar industry has a natural economic equilibrium where China sells the PV panels to the world due to their low cost of labor and the United States/Germany sell the inverters to the world due to the complexity and intellectual prowess required to manufacture. Because PV panels last about 20 years and Inverters last about 7 years, the $0.10/watt inverter price becomes $0.30/watt price over the lifetime of the project, which equals the PV panel cost per project. The solar industry needs China’s cheaper panels to continue to expand, whereas the solar industry needs the technically superior US inverters to continue to expand. It is a very simple quid pro quo situation that the existing tariffs are impacting dramatically. Higher tariffs will accelerate China opening up inverter manufacturers and beginning to gain the intellectual abilities needed to manufacture these difficult pieces of equipment. Without the tariffs, we believe the US will continue to be a major manufacture of inverters for the foreseeable future.

In conclusion, the best outcome for the United States (jobs, domestic energy, reduction of carbon emissions, etc.), as the Trump Administration and Congress work with China on trade negotiations, will be not to increase and actually remove existing tariffs on solar equipment.